Pivot to Profit Series: As integration firms look to recover from the COVID-19 crisis, cash flow forecasting is more important than ever, according to Solutions360’s Brad Dempsey.

In today’s business environment, the term “cash is king” is truer than ever. Most companies have their own version of a cash flow forecast report, but is it accurate and timely? The object of cash flow forecasting is to compare how much cash you receive each month to how much cash you disburse. Putting data behind the numbers becomes very powerful when normal operating functions drive the numbers.

Solutions360’s new cash flow dashboard tool is driven by data, is updated in real-time, and has a high degree of accuracy weeks and months from today.

This month-by-month look forward at your business can help you navigate uncertain times, whether you’re preparing to downsize or getting ready for a return to growth. Because the dashboard updates based on regular accounting procedures, you get an early warning well before an impending crisis.

Elements of Accurate Cash Flow Forecasting

Solutions360’s new Q360 dashboard utilizes seven elements to create accurate cash flow forecasts:

- Cash Receipts: The forecast allows you to use customer payment terms, average pay days, or expected payment dates if you’ve negotiated payment deferrals.

- Overdue A/R: For invoices over 90 days old, you can increase or decrease collection periods. This allows you to see the impact of not collecting overdue accounts or collecting them over longer periods of time.

- Payables: The forecast will use the default due date for vendor invoices or, if you have negotiated a deferred payment to a vendor, its expected pay date.

- Project Invoicing: When projects are created in Q360, invoicing tasks and their amounts can be prescribed for very accurate forecasting of billings.

- Project Material Planning: Within Q360 projects, the material list can be staged to indicate when equipment will be purchased. These costs are factored into the forecast within each period as planned.

- Service Contract Invoicing: Service and managed services contracts are preset in Q360, allowing the forecast to see when monthly, quarterly, and annual invoicing take place.

- Fixed Cost Analysis: Q360 allows you to play with fixed costs. Fixed costs are calculated based on historical periods. By default, the forecast looks back at the last three months of actual fixed costs and uses that data to project fixed costs. You can alter this to any number of months or set a percentage of fixed costs to forecast. Leaving the value at 100% will project the same fixed costs moving forward; change it to 110% to represent a 10% increase to fixed costs or set it to 80% if you are considering layoffs, for example.

Watch a Demonstration of Solutions360’s Cash Flow Forecast & Dashboard

Using the Cash Flow Forecasting Dashboard to Manage Business

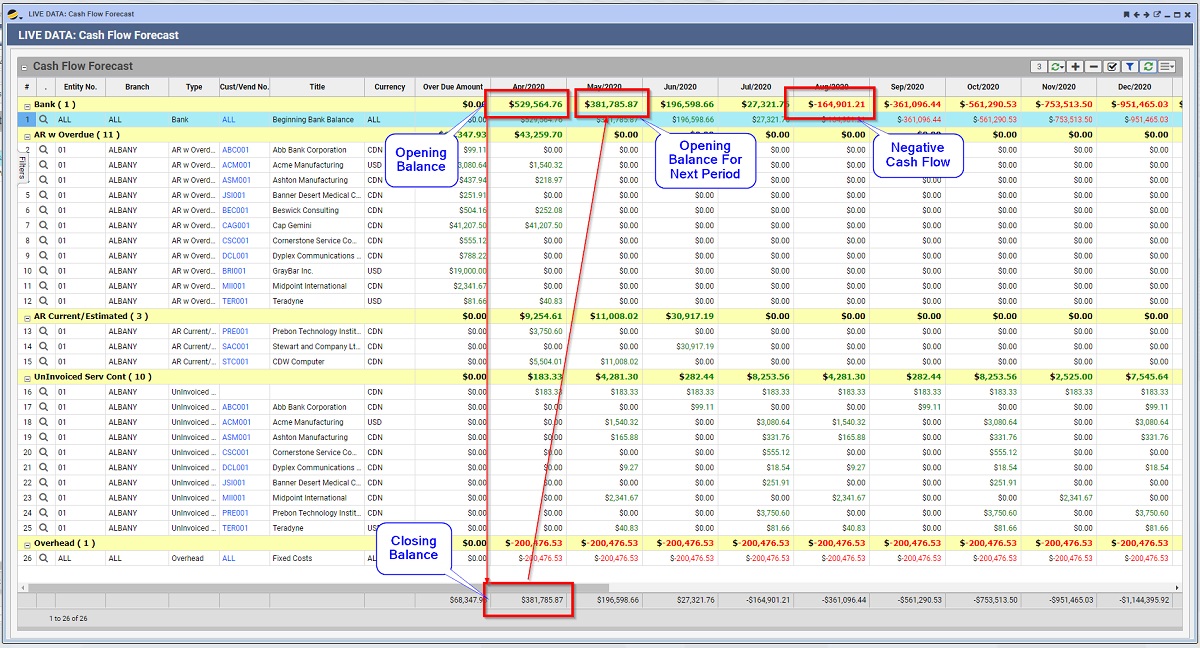

The first rule of accurate forecasting: Base forecasts on data. All dashboards in Q360 begin with underlying data. You can make any query to the database and turn that into a widget for a dashboard. When you run a dashboard, you can pivot from the graphic to the data and back again. The cash flow live data report shows you all data sources in a nice format.

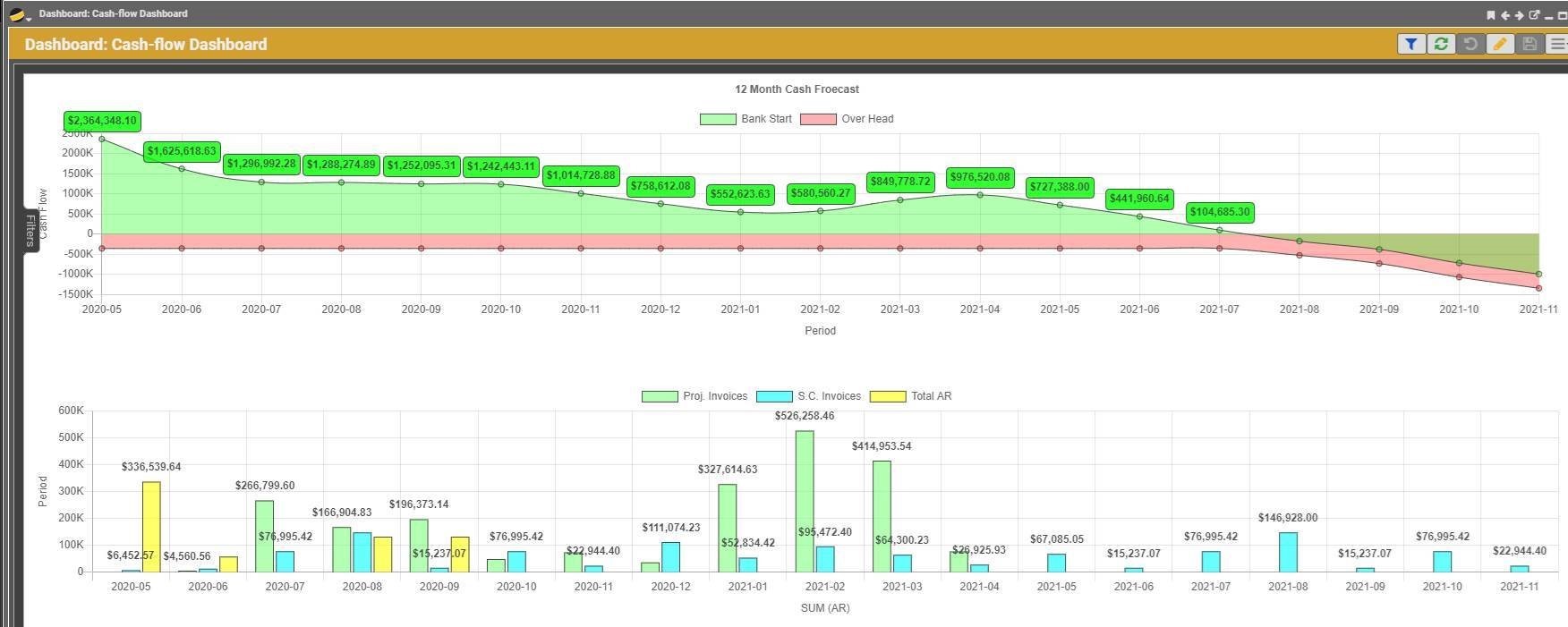

The live data report pivots into the dashboard and shows you the trend for your cash position over time.

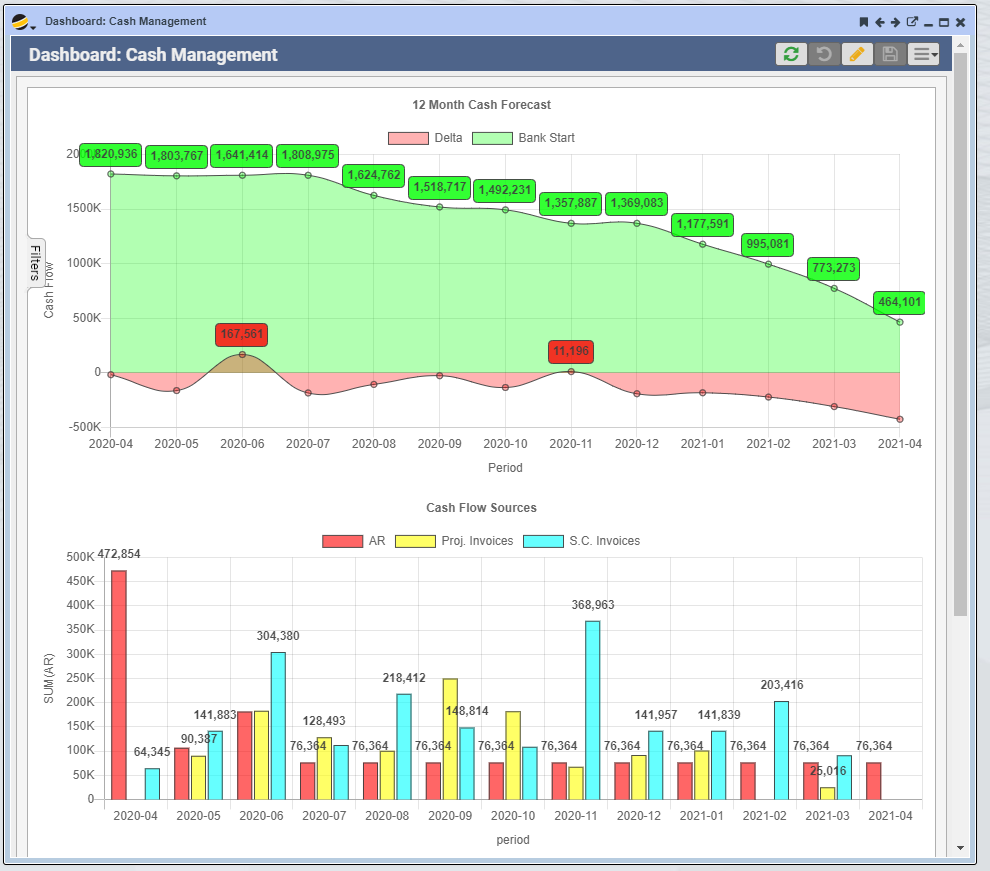

When you adjust your variables, such as overhead values, when you collect money, or late-stage sales opportunities, you will see the impact. In this example below, you’ll be in a cash-negative position in July 2021.

The new Q360 cash flow forecasting dashboard allows you to run different scenarios:

“What happens if I drop my fixed costs to 75% of what they currently are?”

“What will happen if I raise my fixed costs to 125%?”

Looking at the live data report above, the starting bank balance is $529,564.76. As you move from month to month, you can see the invoices predicted to be collected and how they impact ongoing balances.

Looking forward, you can see the beginning cash balance every month. You can see when cash flow is positive or negative, which varies depending on invoices collected each month. Based on this model outlined above, the business will run into a cash crunch in August 2020.

Having this information allows you to plan accordingly and make necessary adjustments before an impending crisis occurs.

Please contact us if you have any questions about cash flow forecasting or how it could help your integration business.

Brad Dempsey is founder and CEO of Solutions360. During NSCA’s 2020 P2Pv, he’s presenting “Cash is King! CFO Perspective on Understanding Liquidity and Cash Flow Managed Services Environment. Register now for 2020 P2Pv to watch on demand.