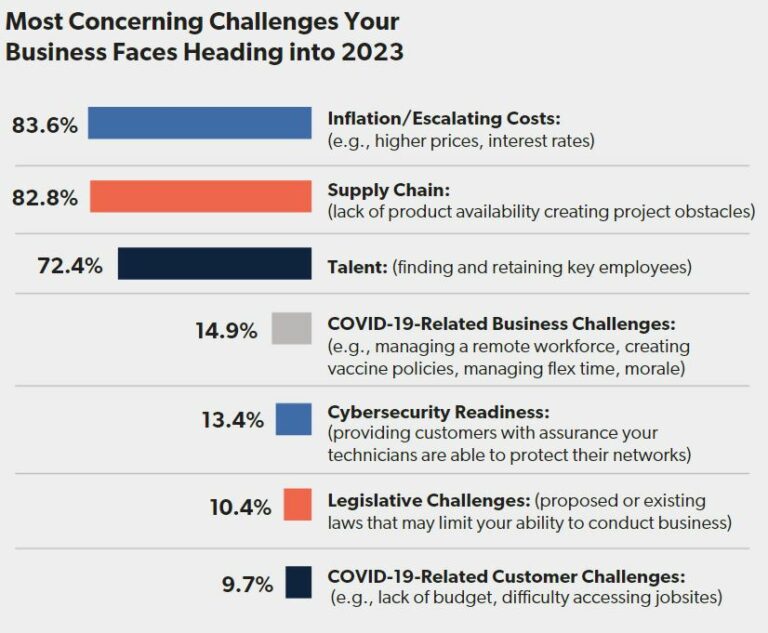

Inflation: 83.6% of integrators name escalating costs, higher prices, and interest rates as their most concerning challenge in 2023.

In the 2023 State of the Industry report developed by NSCA and Commercial Integrator and based on results from a survey of 150+ integration firm owners/operators, inflation was one of the top concerns mentioned throughout the industry this year —along with talent challenges and supply chain snarls.

It’s no wonder that inflation is keeping you up at night: CNBC recently reported that, overall, prices across the board are 13% higher than they were two years ago. In April 2023, inflation slowed to 4.9%. It’s expected that the inflation rate will continue to decline as the year goes on, but no one knows when (or if) it may drop to the Federal Reserve’s target rate of 2%.

In the face of this volatile economic environment, integrators juggle several factors: wage inflation, price increases, logistics costs, fuel surcharges, and the list goes on. As a result, one of the most frequently discussed questions is this: “Do we just pass along the higher costs to clients?”

Of course, there’s no single answer. There are “gotchas” involved with any approach you take to tamping fixed and variable project costs.

True project costs can change quickly, turning once-profitable jobs into work that won’t pay the bills. And many members are understandably passing these costs along to customers. In fact, NSCA CEO Chuck Wilson has seen many integrators racing to pull quotes off the street and reprice them. (Case in point: One NSCA member told its sales team to retract 200 quotes as soon as their expiration date hit.)

You can’t expect clients to be happy when they have to absorb additional costs, but remember: You’re not the only one asking them for more money. Every trade (and likely every organization they do business with) is making similar adjustments and requests to stay in business.

Here are four things you can do to manage inflation.

1. Work with Your Bank on Your Line of Credit

Stay in touch with your bank. Make sure they understand and buy in to what your company does. Do what you can to align payment terms so you don’t have to extend your line of credit for significant periods of time if you don’t want to.

If your line of credit is almost maxed out, but you know that funds are coming soon, you can work with your bank to temporarily increase your line of credit based on backlog and supply chain issues.

2. Buckle Down on Payment Terms

When times are good, it’s much easier to be lax with payment terms. Now is the time to be aggressive. Every payment delay eats into your margins—and even more than it would’ve a few years ago. For example, if the inflation rate is 8%, and your company is paid 90 days after you issue an invoice, then the purchasing power of those funds is about 2% less than it would’ve been on the date of the invoice by the time you receive the payment.

Tell your customers that you can still provide the solutions, services, and quality they need, but they need to pay you in a shorter period of time. Run the numbers to see if offering a discount to customers who pay sooner would be beneficial to you financially (it may very well be).

Remember: If you don’t ask for it, you’ll never get it.

3. Shorten Your Validity Period

During the State of the Industry webinar, Angela Nolan, CEO at Vistacom, shares that her company only holds its price for 30 days. Honoring quotes any older than that can be too risky in a volatile environment.

If you’re not already, also consider escalation clauses that allow you to adjust prices during the contract based on material and other cost increases. And be sure to keep price lists up to date so that your quotes are as accurate as possible when they go out.

4. Use the Electronic Systems Outlook Report as a Guide

Before you take on projects, analyze markets closely. Are they predicted to grow or lag? Are the markets you’re focused on going to do well, or are there some road bumps ahead that may indicate the need to shift directions a bit? Our Electronic Systems Outlook report can be your guide.

Achieving True Growth Amid Inflation

Inflation will likely continue to be the biggest threat to an integration firm’s financial stability this year. What does this mean for you? Forecast and budget appropriately to keep up with inflation. To achieve real growth in 2023, your company will need to grow beyond the rate of inflation.